I represented Compass Well Services, LLC (Compass) in a lawsuit against its insurance company, Great American Insurance Company of New York’s (Great American) that recently concluded in Compass’s favor, when the Texas Supreme Court denied Great American Insurance Company of New York’s (Great American) petition for review. The result: the jury’s verdict finding that Great American must pay Compass more than $5 million stands.

Compass incurred an approximate $1.6 million loss of equipment in an accident. Compass filed a claim with Great American five months after the loss requesting coverage for the loss in accordance with the insurance policy. At the time of the claim, Compass had already disposed of the damaged equipment in the ordinary course of business.

Great American’s adjuster conducted no investigation into the loss and did not interview a single witness. Instead, the adjuster hired a forensic engineering consulting company to investigate the accident. The consultant had worked with the adjuster many times in the past, but the consultant had no oil and gas experience. After months of correspondence between Compass and Great American, including Compass obtaining more information for Great American’s adjuster and consultant, the consultant told the adjuster that he created a narrative of the accident and that the adjuster “may like the [consultant’s] conclusion.” So, the consultant gave Great American’s adjuster a results-based investigation that the adjuster used as a basis to deny coverage to Compass. Great American also stated in its denial that Compass’s disposal of its damaged equipment prejudiced its rights under the insurance policy.

Compass sued Great American for bad faith, unfair settlement practices, failure to promptly pay a claim, and breach of the insurance policy because Great American wrongfully failed to cover its $1.6 million loss. After written discovery and depositions, Compass defeated Great American’s motions for summary judgment and motions to exclude Compass’s experts, and the case proceeded to trial.

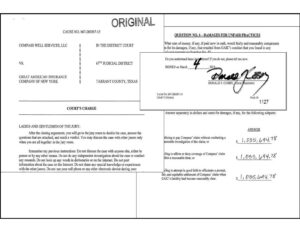

After a one-week trial, the jury found that Great American had investigated the claim unfairly and in bad faith. Great American spoke with no witnesses in its investigation. Great American’s hand-selected consultant issued a results-oriented report that failed to comport with the facts. The jury found that Compass’s disposal of the equipment did not prejudice Great American. The jury also determined that Great American failed to promptly pay Compass’s claim which triggered 18% interest on the amounts Great American owed to Compass. Altogether with damages plus interest, the jury awarded over $5 million dollars to Compass. The appellate court largely affirmed the jury’s award, and the Texas Supreme Court denied Great American’s petition for review.

If you have been treated unfairly by an insurance company, contact Jonny Havens at 713-955-2215 or jonny.havens@havenspllc.com for a free, no-obligation consultation. We typically take bad-faith insurance claims on contingency fee, which means you don’t pay anything unless we recover money from the insurance company.